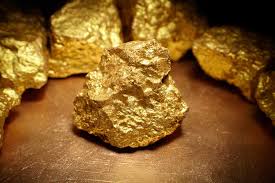

BoU to purchase locally-produced gold to support foreign reserves

The central bank of Uganda announced that it is in talks to start buying gold that is locally produced in order to increase its foreign reserves and address issues with global financial markets.

The domestic gold purchase program intends to mitigate the diminishing foreign currency reserves and handle the related risks in the international financial markets, according to the Bank of Uganda’s (BoU) State of the Economy report, which was released on Thursday.

The nation’s reserve stock stood at roughly 3.5 billion US dollars, or 3.2 months’ worth of import cover, as of April 30, 2024. This figure is just less than the 3.4 months recorded in April 2023.

“This initiative is also expected to support the government’s ongoing value addition to the minerals and Import Substitution Strategy by reducing the imports of raw gold into the country,” the central bank said.

The report states that by buying gold directly from artisanal miners, the BoU will also be assisting small-scale and artisanal miners in maintaining their standard of living, which has a positive knock-on effect on other economic sectors and aligns with the Bank’s mission to support the government’s socioeconomic transformation.

Director of research and policy at BoU and economist Adam Mugume says that the gold will be bought from the local miners, refined to at least 99.5 purity levels, and then turned into monetary gold.

This is a result of low foreign currency inflows brought on by declining budget support, which has limited the amount of foreign currency that can be purchased on the domestic market, according to Mugume.