MPs express concern over the increase in companies receiving tax exemptions

The Ministry of Finance and Uganda Revenue Authority (URA) officials were dismissed by the Finance Committee of Parliament due to issues with the way that seven companies—three of which were higher education institutions—were selected to receive tax exemptions.

The process had obvious irregularities that the lawmakers had pointed out, such as a rise in the number of companies that received exemptions over the initial list that was submitted to Parliament.

Before the finance committee chaired by Amos Kankunda, representatives from the Ministry of Finance Planning and Economic Development, led by the Minister for General Duties, Henry Musasizi, and the Uganda Revenue Authority, led by Sarah Chelangat, the commissioner of domestic taxes, presented a list of businesses eligible for tax exemptions.

Committee members were not pleased when it became apparent during the proceedings that more companies had been added to the list.

Committee members detected a suspicious element even prior to the minister’s presentation, as they learned that the list of companies included had grown from the three that the finance minister had initially proposed for tax waivers on the floor of parliament.

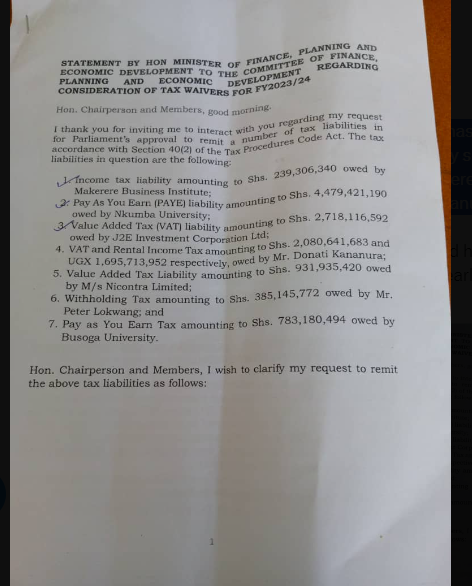

Minister Musasizi asked Parliament to waive off taxes to a tune of Shs13.313Bn owed by several individuals & organizations including; Nkumba University, Makerere Business Institute, businessmen Peter Lokwang, Donati Kananura among others

Musasizi presented the tax liability of Shs239 million for Makerere Business Institute, Shs4.5 billion for Nkumba University PAYE, and Shs2.7 billion value added tax for J2E Investment Corporation Ltd under Section 40(2) of the Tax Procedures Code.